What is the Forex Market?

November 22, 2020

by Bt Stew

A very simple breakdown of the market

In the simplest terms, the Forex Market allows two currencies to trade against each other. You can profit by predicting one currency’s value, higher or lower, versus another currency. When traveling to another country, you usually have to exchange the money in your wallet into that particular country’s currency to buy things.

When you find an exchange booth, you will see screens displaying exchange rates for its currency and others.

The definition of an exchange rate is the rate at which one currency will exchange for another.

You find the “Great Britain Pound” and think toGBP vs. USD | forex signal room | premier forex league yourself, “WOW! Their money is worth way more than mine. I can’t afford anything here!”

When you do this, you have virtually traded within the Forex market!

You have now participated in the exchange of currency!

Or in Forex terms, assuming you’re an American visiting the UK, you’ve sold dollars and bought the GBP.

These changes in the exchange rates allow you to make money in the foreign exchange market.

The Forex Market | What is it?

This market, also known as “Forex” or “FX,” is the world’s largest financial market.

The foreign exchange market is a global, decentralized market where the world’s currencies change hands. Exchange rates vary by the second, so the market is continuously in fluctuation.

Just a tiny percentage of money transactions happen in the real world. Most occur virtually between banks and other countries.

Instead, most of the currency transactions in the global foreign exchange market are bought (and sold) for speculative reasons.

Forex traders (also known as currency speculators) buy currencies hoping that they will be able to sell them at a higher price in the future.

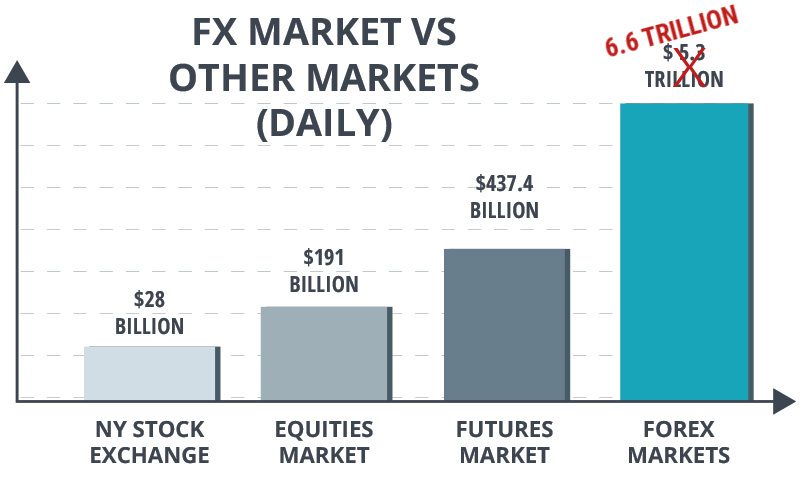

Compare it to the “measly” $22.4 billion per day volume on Wall Street (NYSE). The Forex market looks gigantic with its $6.6 trillion a day trade volume.

Yeah. Trillion! It blows every other market out of the water!

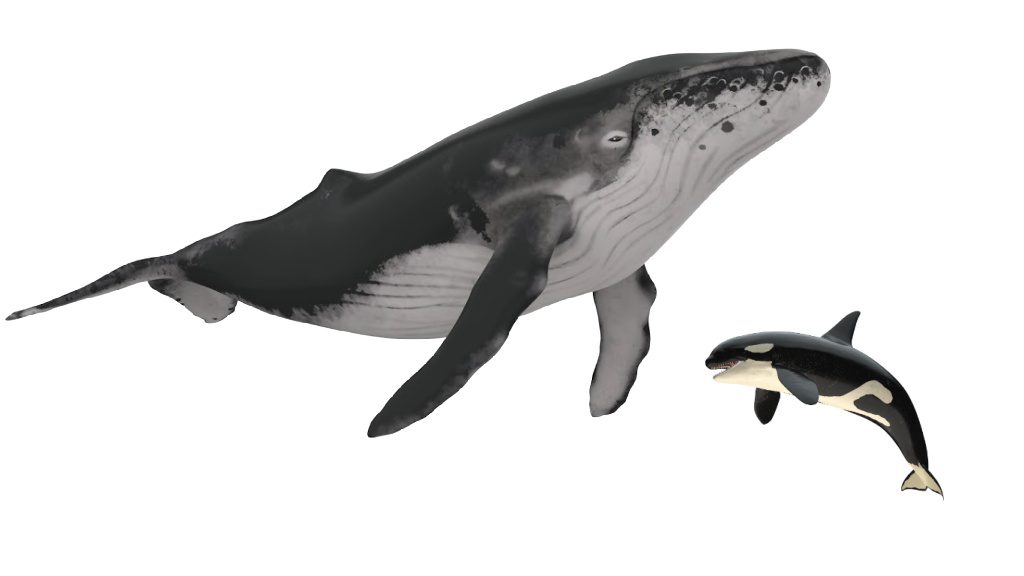

Let’s put this into perspective using whales.

The largest stock market globally, the New York Stock Exchange, trades at a volume of around $22.4 billion each day of the week. If we used a whale to represent the NYSE, it would look like this…

He looks very intimidating. It seems like he is big and tough!

CNBC, MSNBC, Bloomberg, Fox Business all talk about it every day. I’m sure you hear about it at your gym, coffee shop, and work a few times a day. “The market is up today, so on and so on.” When people talk about “The Market,” they are referring to the New York Stock Exchange. So the NYSE sounds huge and as if it is an entire country or world on its own.

But if you compare the New York Stock Exchange to the Forex market, it would look like this.

Oooh, the NYSE looks puny compared to the forex market! It doesn’t stand a chance!

Does it make you wonder if the “S” in NYSE stands for “Stock” or “Scrawny”? Hahahaha

Check out the graph below of the average daily trading volume for the Forex market, New York Stock Exchange, Tokyo Stock Exchange, and London Stock Exchange:

The currency market is over 200 times BIGGER! It is HUGE! But hold your horses, there’s a catch!

That massive $6.6 trillion number covers the entire global foreign exchange market, BUT the “spot” market, which is the part of the currency market relevant to most forex traders, is smaller at $2 trillion per day.

And then, if you want to count the daily trading volume from retail traders (that’s us), it’s even smaller.

It’s hard to determine the exact scale of the FX market’s retail segment. Still, it’s estimated to be around 3-5% of overall daily FX trading volumes, or approximately $200-300 billion (maybe less).

So you see, the forex market is enormous but not quite as massive as it seems.

The colossal number sounds impressive but a bit misleading. We don’t like to exaggerate. We are just trying to be honest and keep it real.

Aside from its size, the market almost never closes! It’s virtually open around the clock.

The FX market is available to trade 24 hours a day and five days a week, only closing down about Friday 5 pm New York time.

So unlike the stock markets, the forex market does not close at the end of each business day.

Instead, the trading moves to different financial centers around the world.

Forex is a Global Market

The day starts when traders wake up in Auckland/Wellington, then moves to Sydney, Singapore, Hong Kong, Tokyo, Frankfurt, London, and finally, New York, before trading starts all over again in Wellington!

Join The Premier Forex League Today!

Read All of Our Great Testimonials!

Amazing

In early 2015 I was searching for a second income, an extra wage to help pay the bills. I’d had a go at MLM but found all the extra work time consuming. I started looking into binary options and in doing some research I came across a BOTS review. Straight away I was impressed but wanted to do some more research and over the next couple of weeks I found myself drawn to the site on a few occasions and in May 2015 I decided to give it a go. Read more...

Jasfran

Master Trader

$97.00

2 Week Trial then renews at $194/mo.

Everything Included! Complete Access to All Services

Delicious

I found this class by accident. I was already doing some forex and binary when I found MT’s site. Getting texts when to buy and when to sell from the other service I was using was a complete joke. I couldn’t stand the waiting and wondering if we were getting a text or not. It always made me wonder where they are getting the signals. How did they know this and why wasn't it more consistent. One thing for sure they did put a lot of hype to get you to join.

Then I found a video of MT’s session. Read more...

BR

Master Trader

11320 State Route 9, Champlain, NY 12919

1-518-531-8698

info@forexsignalroom.com

Live - 8:30 am - 5:00 pm EST Mon-Fri

January

Monday

January

01

1999

Subscribe below for promotional offers & events