Did you know that the average Forex trader in the United States earns nearly $180,000 a year? If that sounds attractive to you then you may be wondering what Forex trading is all about. How do they earn so much money and how can you learn Forex for dummies quickly to start?

Forex, or foreign exchange, is a financial market where traders buy and sell currencies. It can be a lucrative way to make money if you know what you’re doing but it can also be risky. So if you’re new to Forex trading, it’s important to learn as much as you can before starting.

This guide will teach you the basics of Forex trading and what it’s all about, then end with providing some tips for getting started.

What Is Forex?

Forex trading, also known as currency trading, is when you buy and sell currencies on the global market. Forex is one of the largest markets in the world, with a daily trading volume of over $6.6 trillion. This sounds a lot like the stock market, right? Yes, it’s similar, but ultimately they’re two very different things.

Forex is different from other markets, such as stocks and commodities, because it has no central location or exchange. Instead, Forex trading takes place 24 hours a day, five days a week, all over the world. Forex traders can make money either by buying and selling currencies directly or by speculative trading, which involves betting on the future movements of currency prices.

When it comes down to it, we’re honest about the fact that Forex trading is not for everyone. However, it can be a profitable way to make money if you have the knowledge and experience (which we’re here to help you acquire!).

What Does a Forex Trader Do?

So you think you want to trade Forex for a living? It can be a pretty lucrative career choice, but what does a Forex trader do daily?

Forex traders attempt to profit from fluctuations in the exchange rate between two different currencies. For example, if a Forex trader believes that the US dollar will appreciate against the Japanese yen, they may buy USD/JPY. If the US dollar depreciates against the Japanese yen, then the Forex trader will lose money.

This makes Forex trading a riskier form of investment than traditional stock trading. Forex prices can be very volatile, and Forex traders must be aware of the risks involved to make a profit. This is why it pays to participate in a Forex for dummies course (at the very least) or, in a more ideal case, learn from seasoned experts.

What Are Forex Trading Platforms?

Forex trading platforms are software programs that allow traders to buy and sell currencies on the foreign exchange market. There are a variety of Forex trading platforms available, and each has its own set of features and benefits. Some Forex trading platforms offer advanced features such as charting and analysis tools, while others are more simple and more user-friendly.

Selecting the right Forex trading platform is essential for success in Forex trading. After all, it’s where you’ll be viewing everything from a Forex chart to news and trade analyses. We suggest carefully considering your needs and objectives before choosing a Forex trading platform.

Forex for Dummies: 5 Things to Know

Now that we’ve walked you through the basics of Forex trading, it’s time to learn about how to become a great Forex trader. There are Forex trading strategies you’ll need to learn eventually. However, if you’re a total newbie to this type of trading then here are five main tips and fundamental strategies you should learn.

1. Currency Pairs

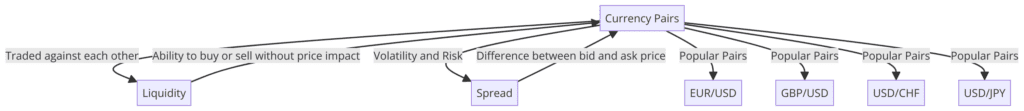

A currency pair is simply two different currencies that are traded against each other. For example, if you buy the EUR/USD currency pair, you are essentially buying Euros and selling US dollars. The value of the currency pair will fluctuate based on a variety of factors, such as economic news and central bank policy.

As a result, currency pairs can be a volatile and risky investment. However, they can also offer the potential for large profits. For this reason, currency pairs are an important part of Forex trading.

The most popular currency pairs in Forex trading are EUR/USD, GBP/USD, USD/CHF, and USD/JPY. These currency pairs have the most liquidity and tightest spreads.

Liquidity is the ability to buy or sell a currency without affecting the price. Spread is the difference between the bid and ask price of a currency pair. The bid price is the price at which a trader can sell a currency pair, and the ask price is the price at which a trader can buy a currency pair.

Got it? Great! Let’s move on to the next Forex trading tip for beginners.

2. Money Management

Anyone who’s ever traded in the Forex market knows that it’s not just about making money it’s also about money management. After all, even the most experienced trader can lose money if they don’t know how to manage their money properly.

One of the most important aspects of money management is risk management. In the Forex market, there is always some risk involved. After all, even the most experienced trader can’t always predict what the market will do.

That’s why it’s important to only invest an amount of money that you’re comfortable losing. This way, even if you do lose money, it won’t be a devastating blow to your finances.

Another important aspect of money management is knowing when to cut your losses. In the Forex market, there will be times when a trade doesn’t go the way you wanted it to. When this happens, it’s important to know when to walk away and accept your losses. Trying to recoup your losses by continuing to trade will only make things worse.

3. Trading Psychology

Want to become a successful trader? You have to understand how the mind works.

Trading psychology is a term that refers to the emotional and mental state of a trader while trading. It includes aspects like fear, greed, stress, etc. All these emotions can have a huge impact on trading decisions and ultimately, the success of a trade. That’s why it’s so important to understand trading psychology and learn how to control these emotions.

One of the best ways to do this is to keep a trading journal where you can record your trades, your emotions at the time, and what led to the decision. This will help you to identify any patterns in your emotions and trading behavior so that you can address them.

Ultimately, managed emotions lead to better trading decisions and improved results. So if you’re serious about Forex trading, make sure to understand trading psychology.

4. Forex Strategy Development

By now you’re likely catching on to the basics of Forex trading. Now, it’s time to start thinking about how you’re going to develop Forex trading strategies. If you’re participating in a course like the one we offer at The Premier Forex League then we can help you identify this, but if you’re not then it’s up to you to learn which strategies feel right.

To minimize your risks and maximize your chances of success, it is important to develop Forex trading strategies that fit your unique investment style. In this context, you must understand the difference between a technical analysis and a fundamental analysis.

When choosing the technical analysis approach, you’ll look at past price movements to predict future trends. If you opt for the fundamental analysis approach, you’ll take into account factors such as economic and political conditions.

Ultimately, the best Forex trading strategy is the one that aligns with your goals and risk tolerance. One thing’s for sure, though. By taking the time to develop a well-thought-out strategy, you can increase your chances of Forex trading success.

5. Forex Brokerage

Now that you have some basic skills and Forex strategies in hand, it’s time to become familiar with Forex brokerages. Forex brokerages are firms that provide a platform for Forex traders to buy and sell foreign currencies. In return for this service, the Forex brokerage charges a commission on each trade that a trader executes.

Why the need for a brokerage? The Forex market is a decentralized market, which means that there is no central exchange where all trades are conducted. Instead, Forex trading takes place through a network of banks, hedge funds, and other financial institutions. Forex brokerages provide access to this network and allow their clients to trade directly in the market.

While there are many Forex brokerages to choose from, it’s important to select one that is regulated by a reputable financial authority. This ensures that your money will be safe and that you will be able to trade with confidence.

Access Our Forex Training

Have you enjoyed our Forex for dummies guide? If so, you’ll likely be interested in joining the Premier Forex League as well. From live trading sessions to access to some of the most accurate Forex signals, we’ve got you covered. Plus, by joining the Premier Forex League, you’ll be part of a community of other traders who can help you learn and grow.

So what are you waiting for? Start today and see your trading career take off!